Efficient Accounting Solutions to Grow Your Business

HR& Payroll

We offer full HR and payroll service

Business Consulting

We are always open to talk and explain all bookkeeping issues

Bookkeeping Service

Full accountancy regardless of Your line of business

About Company

Accounting Services for the Modern Entrepreneur.

A-Z Z-A COMPANIES: provides professional accounting and payroll services. We offer a full range of bookkeeping services, tax consultation as well as business registration and management advisory. My services also include benefits and allowances consultation. I treat my responsibilities seriously and diligently. The customer and his/her satisfaction is a priority, I ensure full discretion of the services provided. I have many years of experience in the accounting sector.

Our Service

Accounting by the Book. Perform with Trust.

PAYROLL

It concerns the area of human resources and payroll. It consists in preparing a pays sheet for the employees and conducting HR matters. This service is based on a system called PAYE (Pay as you earn).

EMPLOYMENT

A TAX Refund is a reimbursement of overpaid taxes for persons in the PAYE system (Pay As You Earn). In order to receive a tax refund, You must submit a P60 from the workplace that You have been employed in, at the end of the tax year. Receiving a tax refund is possible up to 5 years retroactively.

You may apply for a refund during a current tax year if You are no longer employed in the UK or wish to leave for another country. You must submit a P45 from each place of employment in the tax year in question.

SELF-EMPLOYED

It is a sole proprietorship. It is the simplest form of conducting business in England.

The business must be registered at HMRC no later than 3 months after launching. Persons running a one-man business can remain under a contract of employment as well.

As a self-employed person, You have to pay National Insurance Contributions. Every one-man business is assigned a UTR number, it is a 10-digit tax number. Each self-employed business is obliged to submit tax settlements.

VAT

Value-added tax in England is a goods and services tax. It is an indirect tax, and the taxation subject is the value of sales of goods and services, whereas the increase in their net value is the tax basis.

LIMITED COMPANY (LTD)

Private company limited by shares, colloquially known as LTD.

LTD operates under the law of British businesses and has legal personality. An LTD company is created by registering at the Companies House.

It is managed by a minimum of one director and has its own capital, which is the sum of all shares of all shareholders. Shareholders are not liable with their own assets for the company’s obligations, with the exception of their shares

TAX RETURN

(SELF-ASSESSMENT)

Means submitting a tax settlement, in which You state Your income, tax paid to HMRC and the costs incurred by the company. Tax settlement is submitted in writing no later than October 31st, and January 31st

by electronic means.

Lack of a tax settlement causes penalty imposed by the office. The penalty amount is £ 100 and will increase until a settlement is submitted.

Why Choose Us

Keep all the money that is yours

Welcome to the A-Z Z-A COMPANIES. website. We hope that the information contained herein, will be of interest and will encourage You to collaborate with us. We will maintain Your accounting, tackle payroll and matters concerning reorganizing the accounting department. We are flexible and will adapt our accounting services to Your needs and expectations.Client relations based on trust are of greatest value to me. Therefore, each of my customers is treated individually and with proper attention. I utilize my experience and knowledge in accounting. My efforts are appreciated by clients who recommend me to their friends.

We Believe in Best Quality

We Believe in Good Relation

We Believe in Abilities

Easy Step Process

How it works

First Step

Second Step

Third Step

Consultation

Service Process

Delivery

We provide expert advice for all size businesses.

Testimonial

Our Clients Reviews

Very nice staff. They helped me with my application to Universal Credit. I was told to go to this office by a friend and I am happy with the service they provided.

Maha Jaber

Really good accountant I have been with them since 6 years and they are always send me reminders for my company's annual filling. They gave me peace of mind since I joined. Thank you to all of you.

Kelly Jon

Get In Touch

Email: [email protected]

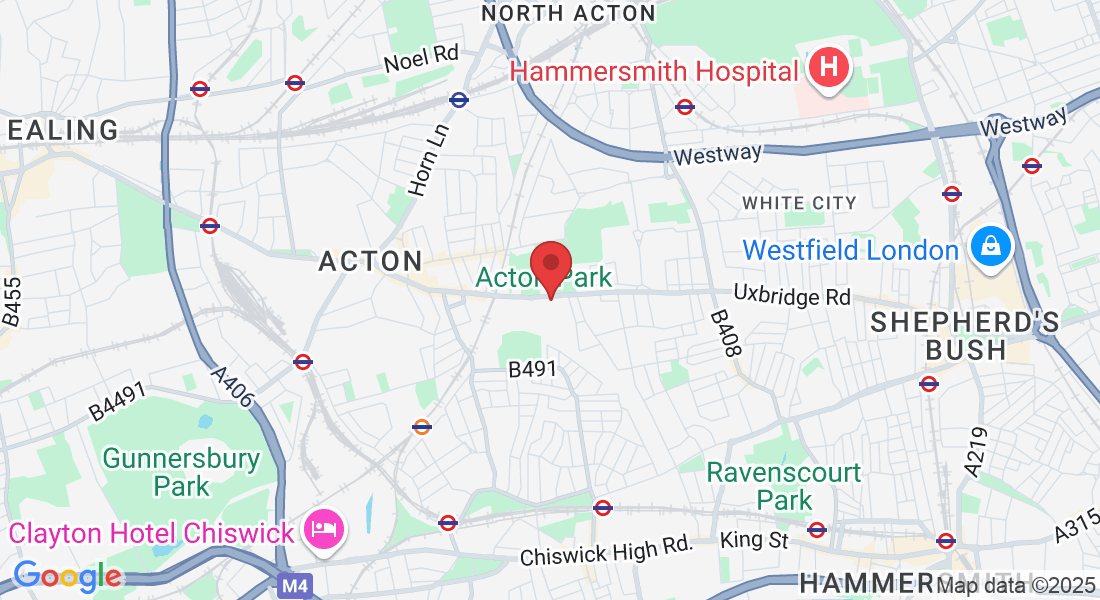

Address

Office: A-Z Z-A COMPANIES

203-205 The Vale, London W3 7QS

Assistance Hours

Mon – Fri 10:00am – 5:00pm

Sunday Saturday– CLOSED

Phone Number:

07861701815

Office: A-Z Z-A COMPANIES 203-205 The Vale, London W3 7QS

Call 07861701815

Site: www.azzacompanies.co.uk